Your Trusted Insurance Agency in California.

Your local insurance agency specializing in families, businesses, and commercial trucking. Request an insurance quote or give us a call at (510) 796-2002 to start the conversation.

3 simple steps to getting insurance.

1. Quote

Provide basic information. We manage the complicated behind the scenes by putting in the work with the insurance companies to make your life easier.

2. Compare

Talk to an agent to find the best coverage. Receive a side-by-side comparison and a complete explanation of your coverages so you understand all your policies.

3. Bind

Get quoted & covered with great rates. Use online e-signatures and payments when purchasing insurance, getting the best coverage and best rates for your situation.

Our trusted partners

We work with the nation’s largest, most reputable insurance companies.

About Walt Anderson Insurance.

We take a hands on approach to insurance guidance. We believe, not only will you find Walt Anderson Insurance knowledgeable, but you will also discover that we are invested in making your needs, wants and wishes a reality. Our unique client experience has been designed with a goal to keep you focused on where you want to go, advise you on how to get there.

Unlike most insurance agents, we have no ties to any one insurance or investment company and we are not incentivized to sell financial products. This absolute independence affords us the ability to do what is truly in the best interest of our clients.”

Insurance meets tech.

Technology should enhance human expertise not replace it. By equipping our elite insurance talent with tech, we’re creating a competitive edge for our people and clients.

Paperless onboarding: our online questionnaire asks the information required, providing more accurate submissions and saving time.

Seamless service: convenient and continuous service, payments, and updates can be made through a secure platform, available 24/7.

Intelligent claims advocacy: experienced claims advocates leverage proprietary analytics tools to resolve claims and reduce the total cost of risk

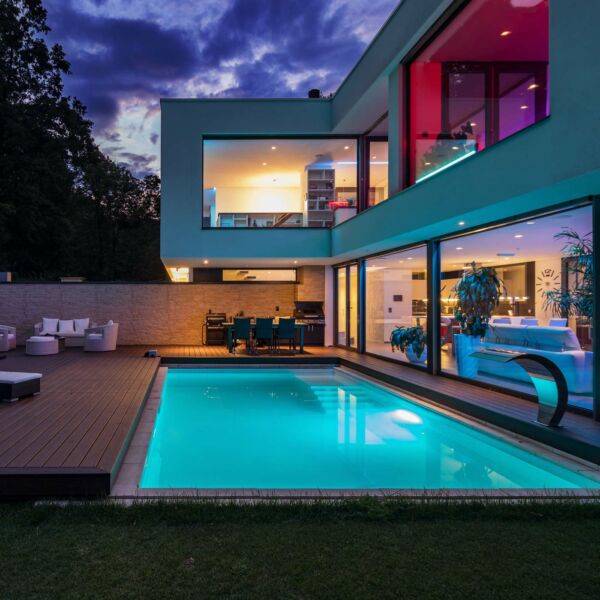

Explore insurance we offer individuals & families.

Top insurance policies to fit your business.

No business is the same, but many companies share common risks. These key commercial insurance policies can help protect your business from common accidents, lawsuits, and damages. We offer tailored policies to help protect your business from fast-moving risks.

Commercial Auto

If your business owns vehicles used for business purposes, such as delivery trucks or service vehicles, commercial auto insurance provides coverage for those vehicles. This includes liability coverage for accidents and physical damage coverage for the vehicles.

General Liability

Provides coverage for third-party claims related to bodily injury, property damage, and advertising injuries. General Liability covers injuries occurring on your business premises or business activities that cause damage to someone else’s property.

Workers Compensation

If your business has employees, workers’ compensation insurance is usually required by law in every state. It provides coverage for medical expenses, lost wages, and rehabilitation costs for employees who are injured on the job.

Commercial Property

Commercial property insurance covers physical assets such as the business building, inventory, furniture, equipment, and fixtures against risks like fire, theft, vandalism, and natural disasters.

Business Owners Policy

A business owner’s policy, aka BOP, is a cost effective way for small business owners to get general liability and commercial property insurance combined into a single policy.

Professional Liability

Professional liability insurance, aka Errors & Omissions (E&O), can help cover legal expenses if your business is sued for a mistake, missed deadline, project scope disputes, negligence, or other risks associated with customer satisfaction.

Commercial Umbrella

Commercial umbrella, aka Commercial Excess, provides additional coverage once the underlying policy reaches its limit. It can boost the coverage for general liability, commercial auto, and employer’s liability insurance.

Cyber Liability

Businesses today increasing rely on digital systems and store customer data electronically. Cyber liability insurance helps cover the costs associated with data breaches, including legal fees, notification costs, and credit monitoring for affected customers.

Builders Risk

Builder’s Risk Insurance, aka Course of Construction Insurance, is a form of commercial property insurance which covers a building while it is being constructed or heavily remodeled.

Commercial trucking vehicles we cover

Service Center.

Our state-of-the-art portal allows businesses to locate, purchase, and manage specialized insurance policies quickly. Weeks-long waiting periods and stacks of paperwork are officially obsolete.

- Request Changes

- Request Certificates

- Report a Claim

- Manage Account

Walt Anderson Insurance. Making insurance easy.

We protect your livelihood. Our goal is to get you the insurance you need, quickly, simply and affordably so you can focus on growing your business, and taking care of your family.

Reading Time: 2 minutesPersonal Belongings and Personal Property A question I get often both from homeowners and renters is “What is considered personal belongings vs. personal property?” A...

Reading Time: < 1 minuteWhat is Auto Safety Insurance? First, let’s be very clear on one thing, California Law requires an owner and operator of a motor vehicle to...

Reading Time: < 1 minuteInsurance Requirements for Contractors Typically contractors and vendors wanting to secure construction contracts, provide services, or be awarded maintenance contracts are usually required to procure...